Data from Statistics Canada’s 2006 “Report on the Volunteer & Charitable Sector,” shows that of the organizations which fall within the standard distribution of the annual revenue of Ontario’s volunteer and charitable organizations (i.e. the Third Sector), 54% have annual revenues under $100,000; 35% between $100,000 to $1,000,000 and 11% over $1,000,000.

The organizations which fall under the “small” and “medium” classifications above, represent the Third Sector. Within the non-profit sector in Ontario, there are approximately 70,000 of these organizations.

These organizations are non-profit organizations and generally seek to spend 80% of revenue on programming and 20% on administration and fundraising. While at times the procurement of management consulting services could fall within programmatic spend, it is most likely found in the administration sections of the operating budgets making only 20% of the total revenue figures stated available for the purchase of management consulting services.

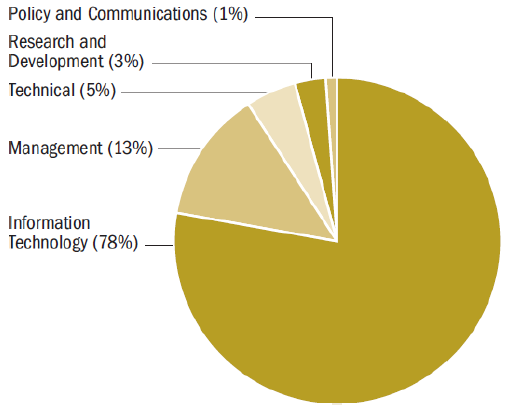

A review of 100 consulting services contracts revealed the ranges of deal-size for contracts awarded to The Big Four are:

1. Small: $50,000 to $149,999 36%

2. Medium: $150,000 to $2,999,999 46%

3. Large: $3,000,000 and up 18%

The average range of an engagement overall was $2,100,000, making these services for the most part, well out the range of purchase for the Third Sector.

From the evidence, it becomes clear that finding economic efficiencies in social services, which will yield a return on the investment already made in the digital transformation of Government, is a natural evolution of the relations between Government and the Third Sector. And as stated, the assumption is made that the lead agent of this change is a “digital transformation and that this will require involvement of consultants. As there is a limited provincial budget, the consultant fees will have to be found via a reallocation of funding.

#MBA #socialinnovation #consulting #digital #government #wbs #bradfordturner #impactinvesting #nonprofit #toronto #thirdsector #impact #policy #socialfinance